FRIDAY, APRIL 20, 2012

Every small business owner needs insurance, but not every small business needs the same insurance. Whether you operate a bike shop or a dog grooming operation, you need insurance that covers your liabilities. Some businesses have a high degree of potential liability and very low degrees of liability. Every business is different but with every business comes some degree of risk. Liability insurance is designed to protect the business owner from the risks of lawsuits and claims for personal injury or property damage. Liability insurance will usually cover legal costs and damages for incidents that are covered by your policy.

It is important to understand the need for liability insurance so you can get the coverage that you need. Here are a few scenarios that might help you see the coverage you need: It is important to understand the need for liability insurance so you can get the coverage that you need. Here are a few scenarios that might help you see the coverage you need:

What is my business burns down, or is flooded and everything is ruined? Property insurance is similar to homeowners insurance and will cover your business from losses that might happen from natural disasters, equipment losses, etc. Business income coverage can also help you recoup lost wages while you rebuild your business.

What if my store is robbed? Again, business insurance coverage is the best coverage for regaining lost businesses because of a named peril. A policy that includes business income coverage provides coverage in the event of many catastrophes beyond your control such as fire, wind, hail, or vandalism that may interrupt your business.

What if my product harms a customer? Whether you’re making board games or cutting hair, there is always the possibility that someone could get hurt. In these instances, either probably damage liability coverage, or commercial general liability would protect your business in the event of a product or service harming a customer.

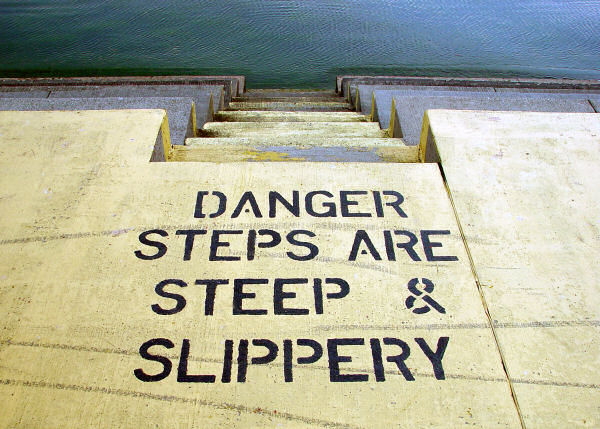

What if a customer slips on my wet floor and is hurt? If a customer gets hurt, general liability insurance with medical payment coverage would help pay for medical expenses for people who are injured at your shop. If an employee is injured, workers compensation insurance would be responsible for coverage.

What if my tools or machinery breaks and must be replaced? Specific policies are available for specific equipment. Equipment breakdown coverage or equipment coverage would cover the tools your business relies on, whether that is a computer or a lawn mower. In large operations where equipment is the life of the company, such as a golf course, commercial property would cover large-scale operations like golf carts, maintenance equipment, and mowers.

When searching for the best business owner's policy, you may want to package a custom policy commonly referred to as “BOP” insurance. This is much like a homeowner’s policy for your business, which offers a variety of coverage in one policy. This bundle option can give you all the crucial coverage for your specific industry.

For example, if you’re opening a restaurant, a common BOP for food service owners includes:

- Property Insurance, for your building, equipment and inventory.

- Business Income Coverage, to protect your income when you must suspend your operations due to a covered loss.

- Bodily Injury Insurance and Property Damage Liability Insurance, which kicks in when your employees, products or services cause harm to other people or their property.

- Equipment Breakdown Insurance to protect you if your equipment is damaged.

- Medical Payments Coverage for medical expenses resulting from injury to others on premises you own or rent.

Small business liabilities are innumerable, and when throwing your time, energy, and life savings in a company and opening it to the general public, it is important to take the necessary steps to protect yourself, your family, and your investment.

By Matt Reynolds - Google+

No Comments

Post a Comment |

|

Required

|

|

Required (Not Displayed)

|

|

Required

|

All comments are moderated and stripped of HTML.

|

|

|

|

|

|

NOTICE: This blog and website are made available by the publisher for educational and informational purposes only.

It is not be used as a substitute for competent insurance, legal, or tax advice from a licensed professional

in your state. By using this blog site you understand that there is no broker client relationship between

you and the blog and website publisher.

|

Blog Archive

|