TUESDAY, FEBRUARY 25, 2014

Getting the best price on insurance is crucial to maintaining the balance between budget and coverage. To get the most coverage at a reasonable price, consider these simple ABC's (and D) of insurance discounts. These simple steps can be used for any insurance policy to save more than 20 percent off your annual premium.

A is for Ask

Insurance companies want to keep your business, they want you to continue paying your monthly bills and they are generally willing to work with you in order to keep your policy current. If you come upon hard times, a decrease in salary, or unexpected bills, contact the insurance company directly, speak with an agent and ask about special discounts, offers, or suggestions they have to decrease your monthly bills. They may have options that are unadvertised discounts available simply to keep your business. Insurance companies want to keep your business, they want you to continue paying your monthly bills and they are generally willing to work with you in order to keep your policy current. If you come upon hard times, a decrease in salary, or unexpected bills, contact the insurance company directly, speak with an agent and ask about special discounts, offers, or suggestions they have to decrease your monthly bills. They may have options that are unadvertised discounts available simply to keep your business.

Questions to Ask Your Agent about Insurance Discounts

- Do you offer any discounts for loyalty members?

- Is there a discount for paying annually or semi-annually as opposed to monthly?

- Is there a way to minimize payments until we get back on our feet?

- Do you offer a discount if I pay early?

- Are their discounts available for bundling services?

- Do you have any promotions or new programs that might work for me?

- Are their gaps or overages in my coverage that may save me money?

B is for Bundle

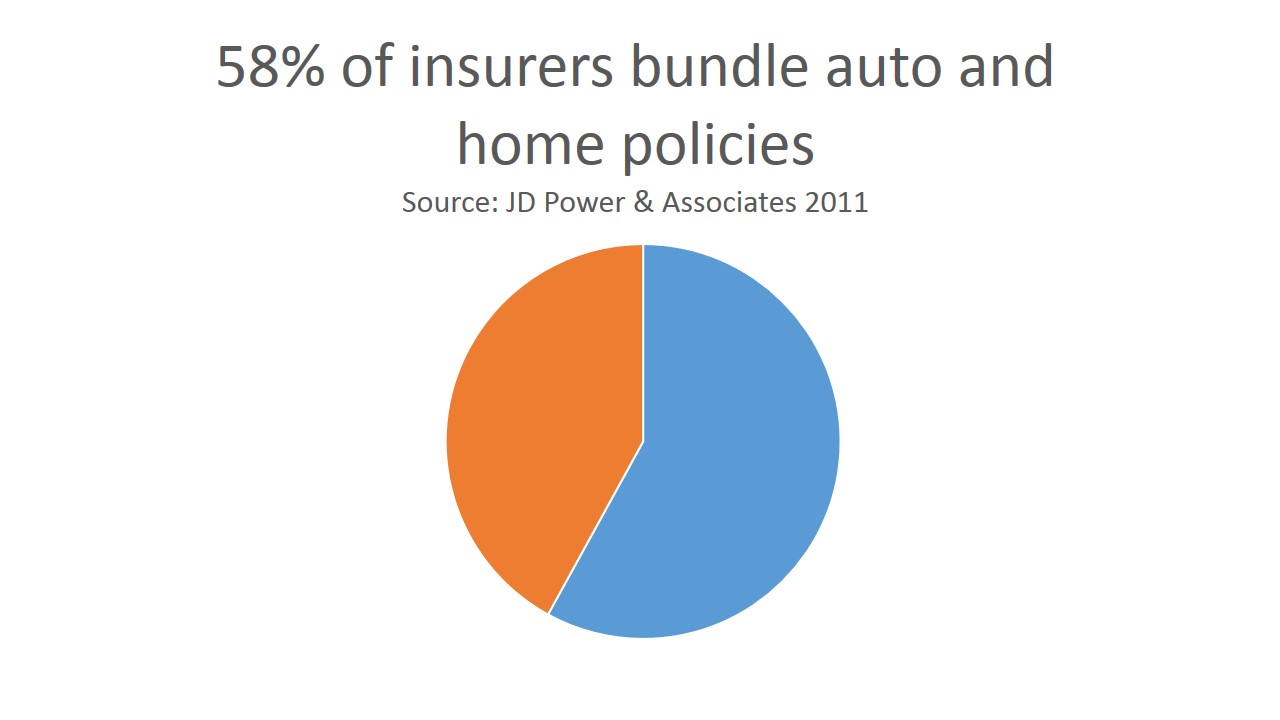

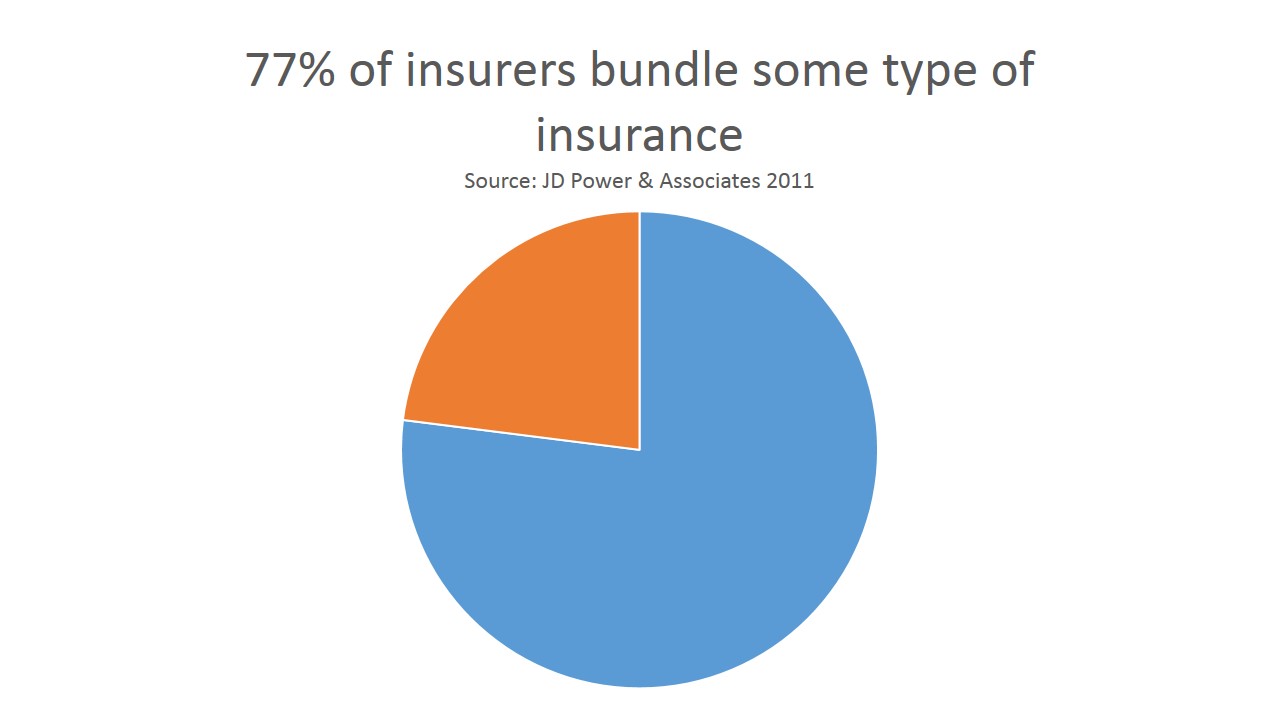

Bundling insurance policies is very similar to bundling your internet and phone lines. Chances are, you have an auto policy as well as either a renter's policy or homeowners policy, you may have additional policies including life insurance, business insurance, or motorcycle and boat insurance. Purchasing multiple policies within the same company can save up to 15 percent on each premium, for a total combined savings of 30 percent or more when compared to separate policies. This can add up to big savings.

Pros of Bundling Your Insurance Policies

In addition to the discounts available to reduce your overall insurance bills, bundling provides the ease of working with just one insurance agent rather than two or three. Because most or all of your insurance needs are coming from one company, it is easy to ensure there are no gaps in your coverage, and easier to make a claim when necessary. For example, if you damage your belongings while moving them, using your own pickup, the car insurance company may say that it’s a homeowners claim, where the homeowner's insurance company may decline coverage because the damage didn't occur at home. With bundled insurance, this is not an issue, because the same company covers both, so regardless of what the outcome is, you are covered.

Cons of Bundling Your Insurance Policies

There are a few cons to bundling insurance including the trouble involved in switching. When working with an independent agent, this switch is easy because your agent can help make the changes and get everything in line. However, if you're working on your own, navigating through the requirements of two companies to cancel one policy and move another can be tricky.

In addition, many homeowners choose to pay their homeowners insurance through their mortgage, and so sometimes even if you have policies through the same company, it may require sending separate payments. This often depends on the company and may vary.

Although, most customers would agree that the savings available from bundling far outweigh any possible inconvenience.

C is for Compare

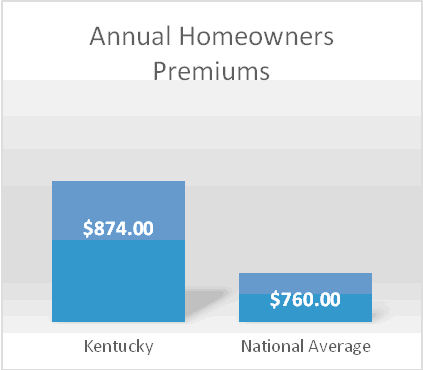

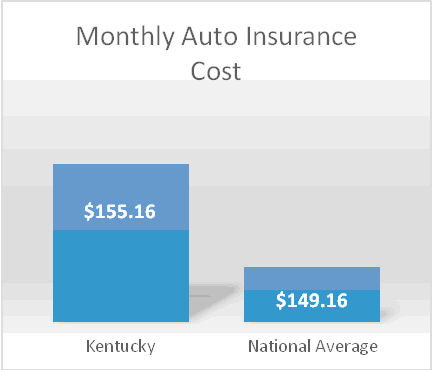

Compare rates, shop around, and do it frequently. Regardless of the type of policy, from auto to home insurance, coverage rates and premiums can be hundreds of dollars in difference between companies. Don't stick with one company just because that's the company your friend, neighbor, or parents use, shop around for your own best rate.

It is recommended to compare rates between insurance companies every year or so. Your life circumstances change all the time, so it is important to review your current policy, and their competitors to be sure you’re getting the best deal. Especially when life circumstances change such as a new home, new car, or increasing life insurance, it’s worth it to shop around and compare companies.

Kentucky Insurance Comparisons for 2012

Benefits of Independent Agents

Working with an independent agent makes comparing companies very easy. Because independent agents represent several different insurance companies, they have the ability to provide an overall view of several different companies to ensure you are getting the best deal. This is much easier than calling different companies yourself and obtaining several different quotes independently.

D is for Deductible

WHAT IS IT?

The deductible is the amount of money you pay out of pocket when you make a claim. Deductibles can vary from $500 to $5000. This is the amount you must pay before the insurance company steps in to cover the rest. The amount of your deductible has a huge impact on your monthly payments.

DEDUCTIBLE V. PREMIUM

Deductible: You pay when you make a claim

Premium: Your monthly payment

SAVE NOW

One easy way to immediately decrease your insurance bills is to increase your deductible. This holds true with every type of policy, the higher the deductible on your business coverage, the lower your monthly payment.

SAVE LATER

A deductible is the amount you will be responsible to pay before the insurer will make payments on a claim. So maintaining a low deductible means you'll have less to pay when an accident or disaster occurs.

PAY NOW, or PAY LATER…

To decide the best deductible, determine an amount that you could pay out for an accident or disaster without causing permanent monetary damage to your family or business. Because most insurers don't experience a major catastrophe every year, usually raising the deductible and sticking with a cheap monthly premium saves people money in the long run. Just be sure to keep a healthy emergency savings account ready to pitch in when necessary.

By Matt Reynolds - Google+

Posted 6:51 PM Tags: save, auto insurance, home insurance, life insurance, business owners insurance, commercial vehicle insurance, boat insurance, motorcycle insurance, renters insurance, auto, home, life, boat, motorcycle, personal, commercial, discounts

No Comments

Post a Comment |

|

Required

|

|

Required (Not Displayed)

|

|

Required

|

All comments are moderated and stripped of HTML.

|

|

|

|

|

|

NOTICE: This blog and website are made available by the publisher for educational and informational purposes only.

It is not be used as a substitute for competent insurance, legal, or tax advice from a licensed professional

in your state. By using this blog site you understand that there is no broker client relationship between

you and the blog and website publisher.

|

Blog Archive

|