WEDNESDAY, DECEMBER 26, 2012

When hurricanes, wildfires, winter storms, or floods fill the evening news, it is a crucial time to review your homeowners insurance policy. After disaster strikes isn't the time to wonder if you have enough coverage. Regardless of the type of home you have, or the area you live in, there is always the chance of a natural disaster destroying your home. It is a risk that is completely unavoidable, which makes having the right amount of homeowner’s insurance coverage more important.

Wildfires: While many of the most famous wildfires burn in California or other parts of the western United States, wildfires can start anywhere there are dry brush conditions. When the flames get close, you don't want to be wondering if your insurance covers the damages. Most wildfires will be covered by homeowners insurance, but it’s worth checking your individual policy. Wildfires: While many of the most famous wildfires burn in California or other parts of the western United States, wildfires can start anywhere there are dry brush conditions. When the flames get close, you don't want to be wondering if your insurance covers the damages. Most wildfires will be covered by homeowners insurance, but it’s worth checking your individual policy.

Wildfires can be difficult to prepare for, but you can protect yourself from their damage. Always close all openings to your house and any other structures on your property including doors, windows and vents. Frequently test your water system to include valves, hose and pump. Always bring flammable outdoor furniture indoors and park your vehicle in a garage.

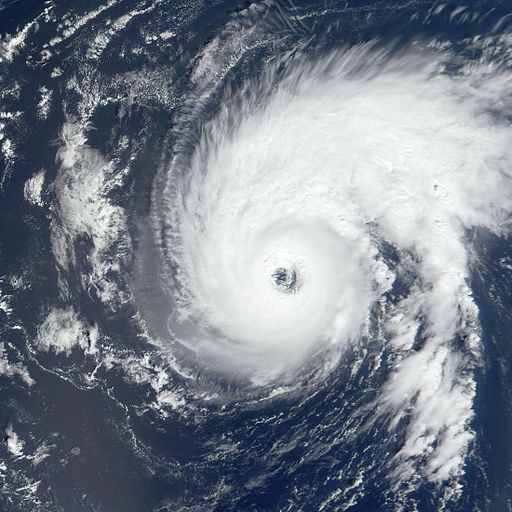

Hurricanes: Hurricanes rule the southern and eastern coasts of the United States. Each year, large and small hurricanes wreak havoc along the coast, but the good news is that a basic homeowners insurance policy will cover you from hurricanes. Hurricanes can cause catastrophic damage not only to coastlines but even several hundred miles inland with winds exceeding 155 miles per hour as well as tornadoes and microbursts.

To begin preparing for a hurricane, you should build an emergency kit and make a hurricane plan by learning the community hurricane evacuation routes and how to find higher ground. Know your surroundings and identify levees and dams to determine whether they pose a hazard to you. Be sure trees and shrubs around your home are well trimmed so they are more wind resistant and reinforce your garage doors.

It is important to understand that most homeowners insurance covers hurricanes, but will not cover any flooding as a result of the rainfall from a hurricane. For this reason, it may be beneficial to purchase additional flood insurance.

Flooding: Flooding is one of the most misunderstood areas of homeowner’s insurance coverage. Damage caused by flooding is not covered under a standard homeowners insurance policy. To protect your home from damages caused by flooding, you will need to purchase flood insurance. Even for those who don’t feel like they live in a high risk flood plain, it still is a good idea to secure some flood insurance coverage. According to the NIFP, 20-25% of flood claims come from outside high risk areas.

Earthquakes: The West Coast is known for being the epicenter of earthquake activity, but there are fault lines across the country including Arkansas, Kentucky, Tennessee, Missouri and Illinois. Like floods, earthquakes aren't covered under a standard homeowners insurance policy. You can purchase extra earthquake insurance from your insurance provider.

To prepare and protect yourself and your belongings in an earthquake, fasten shelves securely to walls, and place heavy objects on lower shelves. Always quickly repair any known defective electrical wiring and gas connections. Strap the water heater to studs in the wall and bolt it to the floor. Lastly, identify safe places in each room that can be used for protection and have disaster supplies as well as an emergency plan on hand.

Tornadoes: Tornadoes predominately occur in the Midwest during the spring, but have been known to occasionally occur in other areas including New York City and the Rockies. The good news for most people living in areas common to tornadoes, is that damage caused by a tornado is covered under a basic homeowners insurance policy.

If you live in an area susceptible to tornados, make sure you have enough homeowner’s insurance coverage to cover the costs of rebuilding, should a twister happen to come your way. If you live in an area that only receives the rare tornado, it might be worth reviewing your policy to be sure you are covered.

By Matt Reynolds - Google+

No Comments

Post a Comment |

|

Required

|

|

Required (Not Displayed)

|

|

Required

|

All comments are moderated and stripped of HTML.

|

|

|

|

|

|

NOTICE: This blog and website are made available by the publisher for educational and informational purposes only.

It is not be used as a substitute for competent insurance, legal, or tax advice from a licensed professional

in your state. By using this blog site you understand that there is no broker client relationship between

you and the blog and website publisher.

|

Blog Archive

|