MONDAY, JUNE 23, 2014

Because each state is unique, various challenges, coverage changes, and circumstances vary depending on where you live. Insurance in Kentucky may look a whole lot different from insurance coverage in Washington or Florida. This article gives you a brief overview of the unique nature and individual challenges facing Kentucky in three main areas of insurance coverage: Auto, Medical, and Homeowners.

Auto Insurance in Kentucky

In 2012, there were nearly 150,000 accidents recorded in the state of Kentucky. Most of these accidents included some type of injury. Without insurance, you would be liable to pay for the property damage, medical costs, and reimbursement for yourself and others involved in the accident.

Kentucky requires minimum insurance coverage in order to protect yourself and other on the road. The minimum insurance requirements for the state are only what you are required to have by law; they are far below recommended amounts. By only carrying the minimum insurance coverage, you are still leaving yourself liable and one accident could put you in serious financial trouble.

Minimum Auto Coverage Requirements in Kentucky

Bodily Injury Liability - Covers death or injury of people involved in an auto accident

- KY Minimum = $25,000 per person and $50,000 per accident

Property Damage Liability - Covers damage to property during an auto accident

- KY Minimum = $10,000 per accident

Personal Injury Protection (PIP) - Personal Injury Protection can be used for medical expenses, lost wages, funeral expenses, and replacement services

- KY Minimum = $10,000 per person per accident

Uninsured or Underinsured Motorist (UM/UIM) - This ensures you are covered even if you are in an accident with someone who does not have insurance to cover your damage or injuries

- KY Minimum = Required

In order to prove you carry the minimum insurance required in Kentucky, carry your insurance card with you personally and in the vehicle at all times.

Common Auto Insurance Discounts

Good Student Discount - An average B student can save up to 20% on insurance premium

Multi-Car Discount - A discount of 10 to 25 percent may be available when you insure more than one vehicle on the same auto policy.

Multi-Policy Discount - Maintaining more than one policy with the same company can bring substantial discounts on each policy.

Homeowner Discount - Some insurers offer a discount for owning a home.

Marital Status - Some companies actually offer lower rates to individuals and couples who are married.

Accident-Free Discount - Maintaining a clean record meaning no at-fault accidents for three or more years often qualifies for significant discounts.

Claim-Free Discount - Drivers who do not file claims over a period of three to five years are viewed as low risk and may receive deep discounts.

Vehicle Discounts - Certain types of vehicles may be eligible for lower insurance rates.

Military Discounts - This is a very common discount offered to members of the military and their immediate family.

Each company has its own criteria, requirements, and the savings vary between companies and location. The discounts you are currently receiving are generally easy to see by looking at the declarations of your policy. Most insurance companies offer several discounts, but may limit the total available discount to a percentage off your full premium. Generally, they allow up to a 25 percent discount off your premium.

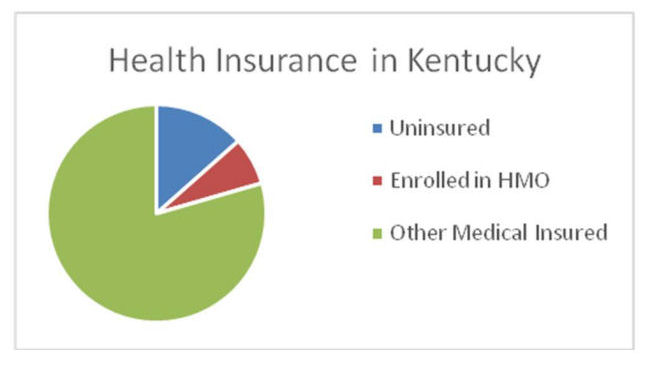

Medical Insurance in Kentucky

Medical insurance has changed across the country and every state has experienced its own unique challenged in recent years. Kentucky is no different.

How Healthy is Kentucky?

According to HealthInsurance.org, Kentucky has room for improving the lives of its citizens. Kentucky has ranked in the bottom 20 percent of states for overall health and is currently ranked 44th in the United Health Foundation's 2012 comparison of health status across the 50 states. This means the need for adequate health insurance in Kentucky is critical.

The Good News:

- Low prevalence of binge drinking

- Low violent crime rate

- Low incidence of infectious diseases

The Bad News:

- Kentucky has the nation's highest percentage of adult smokers: 29.0 percent

- Obesity rates top 30 percent and 29.3 percent of adults are physically inactive

- Kentucky rates 44th in air quality.

- High rate of preventable hospitalizations

- High rate of cancer deaths

Affordable Care Act in Kentucky

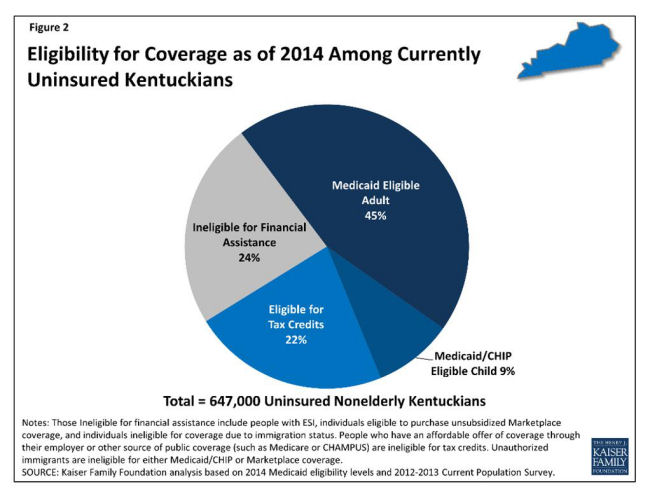

The 2010 Affordable Care Act (ACA) has the potential to extend coverage to many of the 47 million nonelderly uninsured people nationwide, including the 647,000 uninsured Kentuckians. As of January 2014, Medicaid eligibility in Kentucky will cover almost all nonelderly adults who are below the Federal Poverty Level (FPL). The chart below shows how the ACA changes in eligibility and tax credits fill previous gaps in insurance.

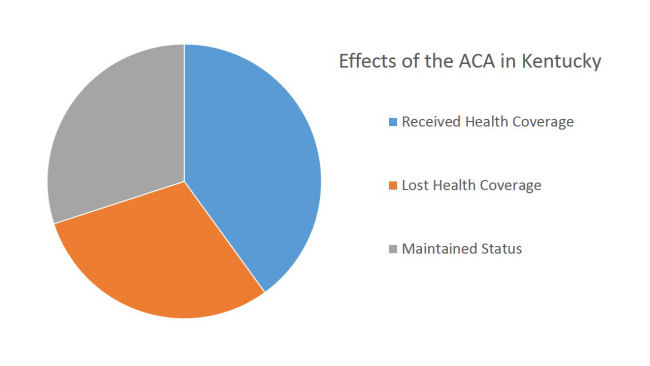

Despite these changes, in April 2014, The New York Times along with the Kaiser Family Foundation examined the public opinion on the results from the Affordable Care Act, The study specifically focused on four southern states: Arkansas, Kentucky, Louisiana, and North Carolina. In each state, the new health care laws received low approval ratings and the majority disapprove of the system. Kentucky received national attention for the success of its state-run health insurance exchange, and majority of state residents say the marketplace is working well.

The poll also shows how the law influenced the insurance coverage of Kentucky residents. The findings were that four in ten individuals in Kentucky say they know someone who was able to get coverage because of the law, but three in ten say they know someone who lost their insurance because of the law.

Homeowners Insurance

Homeowner insurance is as unique as each home. Coverage in Kentucky may have different requirements than coverage in California or Texas because of the unique nature of the area and homes in Kentucky.

Homes in Kentucky

Average Cost of Homeowners Insurance

|

$601 / Year

|

Average Value of Home

|

$117,800

|

Average Age of Home

|

32 Years

|

% of Homes Owned

|

70.3 %

|

Average Household Size

|

2.47 People

|

Yearly Household Burglaries

|

30,311

|

Tornadoes per year

|

36

|

Flood Claims per year

|

1,260

|

Source: Kentucky Department of Insurance

Main Aspects of Your Homeowners Insurance Policy

1. Dwelling: Dwelling coverage includes the home itself, plumbing, electrical, roof, and walls.

2. Other Structures: Any manmade items on the insured property like a separate garage, fence, or guesthouse.

3. Personal Property: The contents of the home including electronics, jewelry, photographs, rugs, furniture, and any outdoor equipment you own.

4. Loss of Use: The costs required to stay somewhere else while your home is unlivable.

Loss of use reimburses you for any costs you can verify that would normally be part of your everyday life.

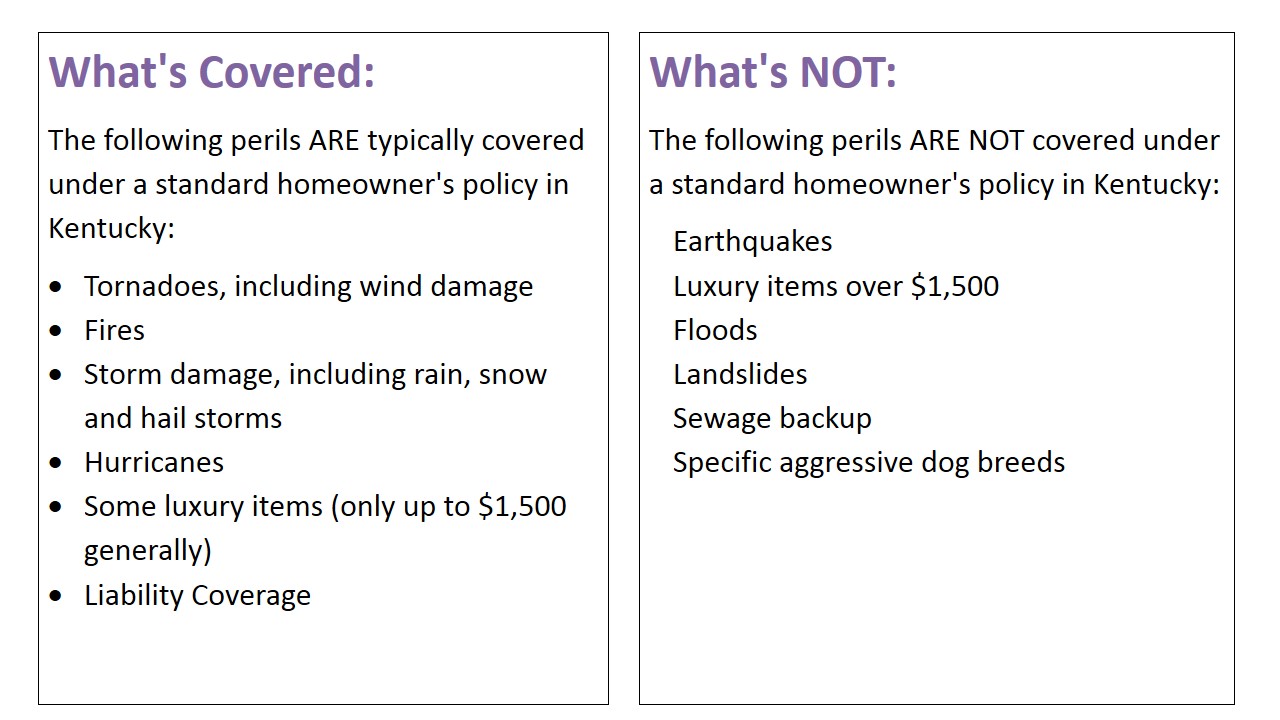

Kentucky home insurance is unique and includes coverage for a wide range of perils, but it does not protect against everything. In addition, prices for different coverage can range greatly depending on the area you live.

Additionally, if you have a shed or other structure on your property, they are also automatically covered. With some policies, identity theft insurance may or may not be included.

Kentucky Homeowners Insurance Discounts

The most popular and homeowner's insurance discounts in Kentucky include the following:

Home Security: Installing a video alarm system that is monitored offsite will get you a discount with your insurance company. A cheaper, but also effective option is to install deadbolts in all your exterior doors, which will also get you a discount.

Quit Smoking: Because so many house fires are linked to smoking, show your insurance company you have quit and you can save money on your policy.

Credit Score and Insurance Risk: 680 is the average credit score in Kentucky, which is somewhat higher than the 650 score that most insurers begin offering insurance discounts at. Take advantage of your good credit and enjoy a lower insurance rate.

By Matt Reynolds - Google+

No Comments

Post a Comment |

|

Required

|

|

Required (Not Displayed)

|

|

Required

|

All comments are moderated and stripped of HTML.

|

|

|

|

|

|

NOTICE: This blog and website are made available by the publisher for educational and informational purposes only.

It is not be used as a substitute for competent insurance, legal, or tax advice from a licensed professional

in your state. By using this blog site you understand that there is no broker client relationship between

you and the blog and website publisher.

|

Blog Archive

|